annual federal gift tax exclusion 2022

Ad Compare Your 2022 Tax Bracket vs. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS.

2022 Updates To Estate And Gift Taxes Burner Law Group

The lifetime exemption for both gift and estate taxes was 117 million per individual for last year.

. The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because the gifts would occur in two separate years. The tax will also come due if you cumulatively exceed the exclusion amount. The annual gift tax exclusion is 16000 for 2022.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who. How the Annual Gift Tax Exclusion Works. S2 has made no prior taxable gifts.

The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. On April 15 2021 S2s executor files a Form 709 United States Gift and Generation-Skipping Transfer Tax Return claiming an applicable exclusion amount of 11580000. 2022 and 2021 Federal.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift.

For 2018 2019 2020 and 2021 the annual exclusion is 15000. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. S2s executor tenders payment of the gift tax with the Form 709.

You need to file a gift tax return using IRS Form 709 any year in which you exceed the annual exclusion. If you managed to use up all of your exclusions you might have to pay the gift tax. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any. Gifts to beneficiaries are eligible for the annual exclusion. Annual Gift Tax Exclusion.

You can leave up. The federal estate- and gift-tax exemption applies to the total of an. Your 2021 Tax Bracket To See Whats Been Adjusted.

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary. You dont actually owe gift tax until you exceed the lifetime exclusion which is 1206 million in 2022.

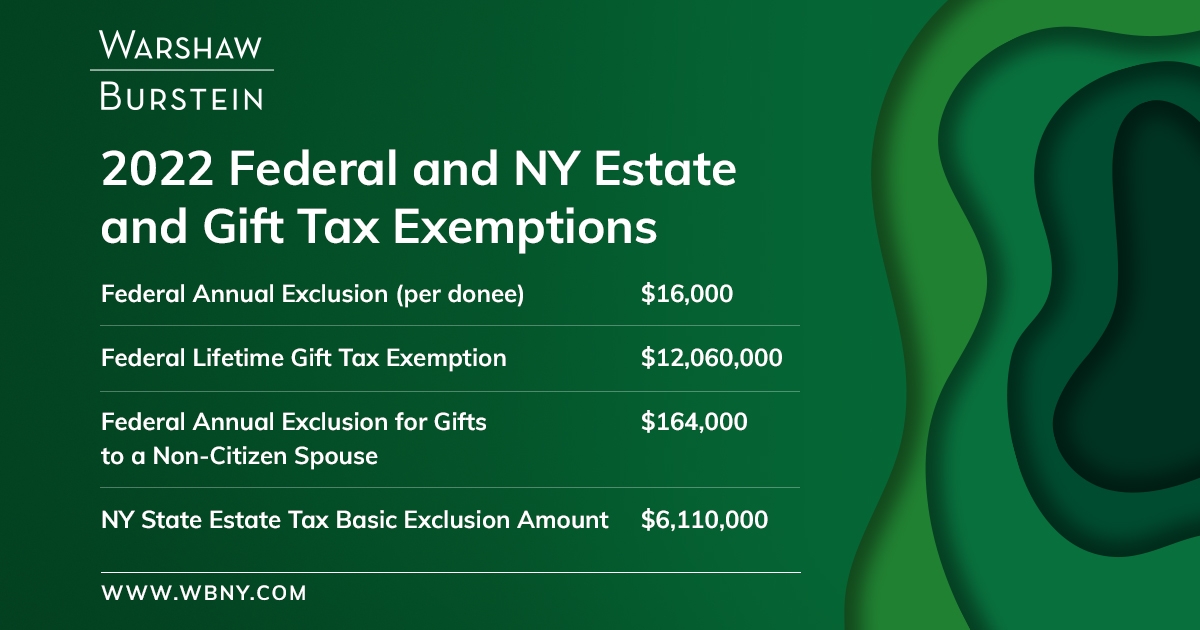

Giftestate tax lifetime exemption increases from 117 million to 1206 million. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The gift tax annual exclusion amount per donee has increased to 16000 for gifts made by an individual and 32000 for gifts made by.

The IRS also increased the annual exclusion for gifts to 16000 in 2022 up from 15000. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. Gift tax annual exclusion increases from 15000 to 16000.

Generation-skipping transfer tax lifetime. This increase to the federal estate and gift exemption amount to 12060000 means that estates of individuals who die in 2022 with combined. Annual Gift Exclusion.

The exclusion is portable and this means that a surviving spouse. The rate of taxes imposed for gifts over the annual gift tax limit varies between 18 to 40. So even if you do give outrageously you wouldnt have to file a gift tax return unless you went over those limits.

However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax. It increased the exclusion from 549 million to 1118 million. The gift doesnt have to be made in one lump sum.

Posted on December 24 2021. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year.

You can give up to this amount in money or property to any individual per year without incurring a gift tax. Although there is near-universal acceptance of the importance of gifting. Also note that gifts to a spouse are usually not subject to any federal gift taxes as long as your spouse is a US.

The federal estate tax exclusion is also climbing to more than 12 million per individual. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts.

After exceeding the 15000 there is a 1206 million federal estate tax exemption for 2022. Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. In 2022 you can give 16000. The federal government imposes a tax on gifts.

Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for gifts made in 2021 2. There have been inflation adjustments each year since then and in 2022 the exclusion is 1206 million. If gifts are made through a trust the trust must be written to include crummey.

In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. The amount you can gift without filing a tax return is increasing to 16000 in 2022 the first increase since 2018. The federal estate tax exclusion is also climbing to more than 12 million per individual.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This means that any person who gave away 16000 or less to any one individual anyone other than their spouse in 2022 does not have to report the gift or gifts to the IRS. Tax and Estates Alert.

How the gift tax is calculated and how the annual gift tax exclusion works. The federal estate tax exclusion is also climbing to more than 12 million per individual. The maximum rate of the federal estate tax is 40 percent so it can have a significant impact on your legacy.

Makes a gift to Child of 13000000 on December 1 2020. Wednesday March 2 2022. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted.

The annual exclusion for 2014 2015 2016 and 2017 is 14000. The annual gift tax exclusion is 16000 for the 2022 tax year.

What Is The Lifetime Gift Tax Exemption For 2021 Smartasset

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Warshaw Burstein Llp 2022 Trust And Estates Updates

When A Gift May Not Be A Gift Wilson Law Group Llc

Gift Tax Limit 2022 What Is It And Who Can Benefit Marca

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2020 1099 Misc Irs Copy A Form Print Template Pdf Fillable Etsy In 2022 Print Buttons Irs Print Templates

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

Irs Announces Higher Estate And Gift Tax Limits For 2020

Gift Tax Explained 2021 Exemption And Rates

Avoid The Gift Tax Return Trap

The Hidden Costs Of Making A Gift Snyder Law

Gift Tax What Is It How Does It Work Personal Capital

How To Make The Most Of The Annual Gift Tax Exclusion Isdaner Company

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Do I Have To File A Gift Tax Return Jmf

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Gift Tax In 2021 How Much Can I Give Tax Free The Motley Fool